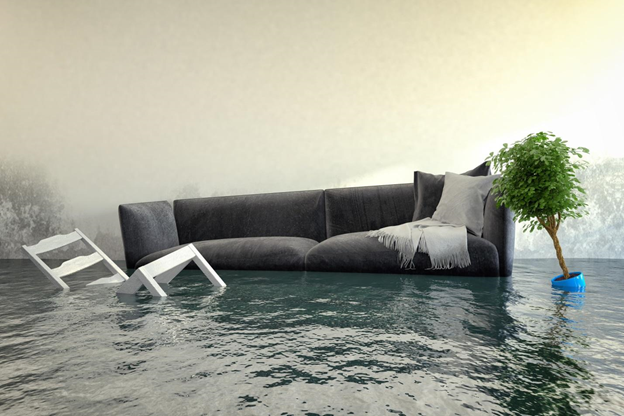

Do you live in the 100-year floodplain?

In the United States, the 100-year floodplain is an area of land most likely to experience extreme floods. Significant floods in this area have cost the United States billions of dollars. Residents living around the Mississippi river know how devastating floodwaters can be.

Whether you are a renter or homeowner, you should do yourself a favor by getting a flood policy today. But watch out! There are many misconceptions about what is and isn’t covered through flood insurance.

How exactly can a flood insurance policy protect your home? Read on to find out.

Do You Have To Carry Flood Insurance?

Are you legally required to carry flood insurance? As a property owner, you’ll need to determine if you live in a high-risk flood area. If you live somewhere prone to flooding, you probably have to carry flood insurance.

Are you getting ready to close on a new home? Your mortgage company isn’t going to let you go finish the closing process until you can prove that you have a flood insurance policy in place.

It doesn’t matter whether or not you live in a low-risk or high-risk area. Flood insurance policies are so affordable it makes sense for everyone to have them.

Did your household receive disaster assistance at some point? If you receive disaster assistance on a federal level for floods and live in a high-risk flood area, you’ll have to get insurance. The government wants to know that you’ll be able to take care of any issues moving forward.

Fast Flood Insurance Payouts

If you already have a homeowners or renters insurance policy, do you need a flood one? Yes.

Homeowners’ and renters’ insurance policies don’t cover flood damage. There are particular situations where a home policy will cover portions of flood damage, but it’s not likely. To have full coverage for your home and belongings, you’ll want to have an active flood policy.

Flood insurance pays claims whether or not there’s a presidential disaster declaration.

You’ll be able to enjoy fast funds, making it easier for you and your family to recover. At the same time, those waiting for assistance from federal disaster loans might have to deal with long wait times.

Waiting for Government Assistance

Federal disaster assistance typically comes in 2 different forms; loans and grants. If it’s a loan, you’ll be responsible for paying it back with interest. Unfortunately, disaster loans are usually barely enough to complete repairs.

It’s normal for a flood insurance claim to be $40,000 or more. Typical disaster loans usually cap out around the $5,000 mark.

Even if you’re able to get assistance from the government, it’s probably not going to be enough. Play it safe. Get a cheap flood insurance policy with the highest limits possible if you want to protect your home.

How Flood Insurance Works

Your flood insurance policy will cover all of the physical damage to your personal belongings and property. There will be a definite cap for how much you can receive. The amount you can receive will depend on the limit set when you begin the policy.

For instance, somebody buying a policy for a $500,000 home will have high coverage limits. Whereas somebody purchasing a flood policy for a $100,000 home will have lower policy limits.

Along with the building, the policy will also protect your electrical and plumbing systems. You’ll also have coverage for your furnace and water heater.

Appliances such as your fridge, stove, and even built-in dishwashers will have coverage. As far as flooring goes, any permanently installed floors will also be safe. The policy will also cover your furniture, electronics, clothing, and other personal belongings.

Do you have a detached garage? You might need to purchase a separate building policy for the garage if it’s not connected to the home.

Is All Water Damage Covered?

What is not covered by your flood insurance policy? As with any insurance policy, you won’t receive coverage if you neglect to protect your home.

If there is mildew or moisture in your home, and it’s something you could have prevented, your flood policy isn’t going to cover that. Whereas, if there’s moisture and mildew in your home because of a recent active flood, you’ll have the coverage you need.

What Isn’t Covered With Flood Home Protection

As far as paper money and precious metals go, these won’t have coverage under your flood insurance policy. You also won’t have any coverage for anything outside of your home.

The trees in your yard, your expensive patio pavers, and your lovely backyard deck won’t have coverage through a flood policy. This includes swimming pools, hot tubs, fences, walls, and anything outside of your home.

What About Living Expenses?

After a flood, your home’s not going to be livable. Unfortunately, your flood insurance policy isn’t going to cover living expenses. It’ll be up to you and your family to cover the cost of rent while your house is being repaired.

You’ll have to find alternate living accommodations that could last years, depending on the extent of the damage. In some cases, your home insurance policy might be able to kick in to help pay for a portion of the living expenses. However, there will be a limit to what the home insurance company can help with.

Protect Your Home and Loved Ones

Congrats, now you know more about how a flood insurance policy can protect your home. Find out if you live in a high-risk flood area today. Even if the risk is low, find out what a policy would cost you.

You’ll find that flood insurance is a lot less expensive than traditional homeowners insurance, and it’s easy to get a policy set up. Before agreeing to any insurance, make sure you fully understand the coverage limits. If you’d like more ways to protect yourself and your loved ones, see what the rest of our website can help with.